Exploring the Disparity in Valuations: Premier League Teams vs NFL Franchises.

The Premier League and the NFL stand as two titans in sports leagues, commanding vast audiences and generating significant revenue. However, a curious paradox exists: NFL franchises are often valued much higher than their Premier League counterparts, despite the Premier League boasting a far larger global audience.

Why would that be the case? I decided to do a bit of research and this is what I found.

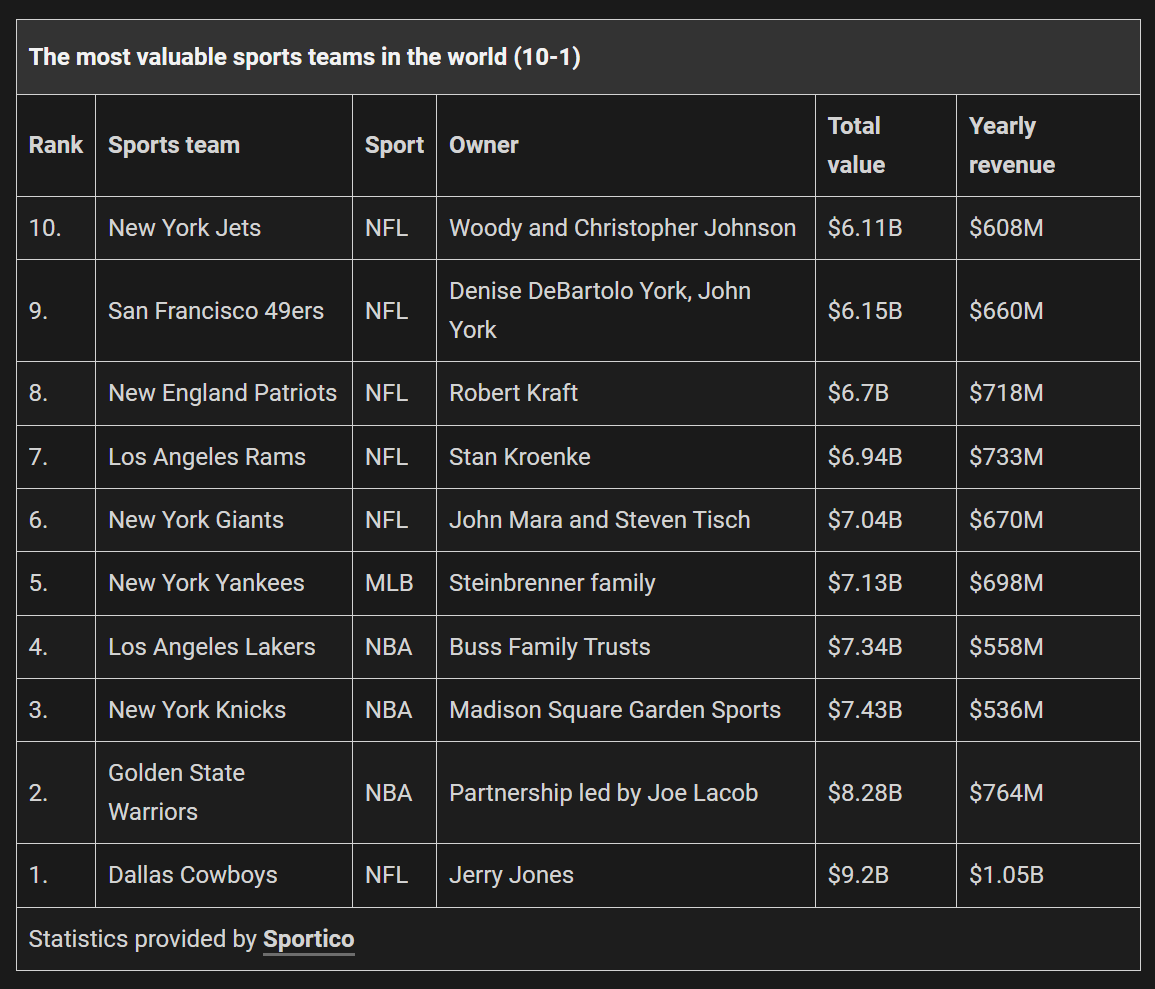

To start, here are the top 20 most valuable sports teams in the world.

Among the top 20 most valuable sports teams: 12 are NFL franchises, 3 are from the NBA, 3 are from the MLB, 2 are from the world of football (soccer for clarity), and only 1 of those is from the Premier League (Manchester United).

Here are some of the reasons why the Premier League teams fall behind the NFL in brand valuations.

Broadcasting Deals: A Tale of Two Models

The NFL’s broadcasting deals are a cornerstone of its financial might. The league’s recent agreements (2023) with major networks and streamers like ESPN, NBC, CBS, Fox, Amazon and YouTube, collectively amount to over $125 billion. This averages around $10 billion annually as the main agreements run until 2033. The NFL’s revenue-sharing model ensures that this windfall is distributed equally among all 32 teams, providing each franchise with a stable and substantial income.

In contrast, the Premier League’s broadcasting revenue, while substantial, is distributed differently. The domestic broadcasting rights for the 2022-2025 cycle are worth around £5.1 billion ($6.8 billion), with international rights bringing in over £4.2 billion ($5.6 billion), that’s $3.9 billion annually compared to the NFL’s $10 billion.

It’s worth noting, that the NFL’s distribution is across 32 teams compared to the Premier League’s 20 teams and the Premier League has an uneven distribution based on league positions and televised matches, meaning the top teams get the lion’s share.

According to the Premier League website:

50 per cent is divided equally between the clubs, 25 per cent is awarded on a merit basis, determined by final league positions, and 25 per cent is distributed as a facilities fee for televised matches.

Market Dynamics and Brand Management

The economic power of the U.S. market plays a pivotal role in the higher valuations of NFL franchises. The United States has a high per capita income, resulting in more disposable income for entertainment, including sports. American consumers are among the highest spenders on sports-related activities, driving up the value of advertising slots during NFL games.

Moreover, the NFL’s cultural significance in the U.S. cannot be overstated. Events like the Super Bowl transcend sports, becoming cultural phenomena that attract viewers beyond regular football fans. The Super Bowl’s halftime show and high-profile commercials further amplify its value.

The Premier League has a much larger global audience, with a significant following in Asia, Africa, and the Americas. This global reach contributes to its substantial broadcasting and commercial revenues. However, the revenue per viewer is generally lower than that of the NFL’s U.S.-centric audience due to varying economic conditions and advertising markets across different countries. The Premier League’s global appeal is fragmented, with varying levels of engagement and advertising value depending on the region. This fragmentation impacts the overall revenue potential and, consequently, the valuation of the clubs.

Game Structure and Advertising Opportunities

The structure of NFL games, with frequent stoppages and breaks, allows for numerous commercial opportunities. On average, an NFL game includes about 20 commercial breaks, leading to approximately 60 minutes of commercial time per game. This high volume of advertisements significantly boosts the revenue that networks can generate from NFL games. The ability to intersperse ads without disrupting the flow of the game maximizes financial returns from each broadcast, making NFL broadcasting deals extremely lucrative.

In-game Commercial Opportunities

- Touchdowns and Field Goals: Each scoring play is followed by a commercial break, allowing advertisers to target moments of high viewer engagement.

- Timeouts: Teams have multiple timeouts per game, each providing a natural pause for advertisements.

- Injury Timeouts: Unplanned but frequent, these breaks offer additional ad slots.

Premier League matches, with their continuous 45-minute halves and limited breaks, offer fewer opportunities for in-game advertisements. The main commercial opportunity is during the 15-minute halftime break, with additional ads shown pre-match and post-match. While in-game advertising methods such as digital advertising boards provide brand exposure, they do not command the same premium as traditional commercial breaks. This structural difference in gameplay limits the total ad time available during Premier League broadcasts, impacting the overall revenue that can be generated.

Revenue Sharing and Financial Stability

The NFL’s centralized revenue-sharing model ensures that all teams benefit equally from broadcasting, merchandising, licensing and ticketing deals. This model promotes financial stability and parity across the league, making each franchise an attractive investment. The equal distribution of revenue supports competitive balance, enhancing the overall brand strength of the NFL.

- Revenue Stability: Each NFL team receives an equal share of the massive broadcasting revenue, ensuring financial stability regardless of on-field performance. This reduces financial risk and increases the attractiveness of investing in any NFL franchise.

- Merchandising and Licensing: The NFL’s centralized approach to merchandising and licensing generates significant revenue that is evenly distributed among teams. This contrasts with the Premier League, where individual clubs negotiate their own deals, leading to disparities.

- Ticketing: Each NFL team receives over $20 million as part of the league’s ticket-sharing agreement. This agreement dictates that 34% of each team’s ticket revenue goes toward a shared pool to be distributed equally. This means that 66% of the $18.7 billion in 2022 NFL revenue was distributed in equally to all 32 teams.When you consider that NFL teams only have 10 home games a year, including preseason, they still manage to generate over $3 billion a year in attendance revenue.

The Premier League does not implement such a system. Each team manage and keep the revenue from merchandising, sponsorship and ticket sales for their home matches. This includes season tickets, individual match tickets, and hospitality packages.

Cultural Significance and Advertising Value

Super Bowl as a Cultural Phenomenon

The Super Bowl exemplifies the NFL’s ability to create high-value cultural events. It consistently draws over 100 million viewers in the United States alone, with global viewership estimates ranging between 150-200 million. This concentrated viewership makes the Super Bowl an unparalleled advertising platform.

- Advertising Premiums: Companies pay upwards of $5-7 million for a 30-second ad spot during the Super Bowl. The ads themselves often become cultural talking points, further amplifying their value.

- Engagement: The Super Bowl attracts a diverse audience, including many who do not regularly watch NFL games, creating a unique advertising environment with high engagement levels.

Premier League’s Global Audience

While top Premier League games attract a significant global audience, the viewership dynamics differ from those of the Super Bowl. Major Premier League matches like Manchester United vs Liverpool can attract around 600 million viewers globally, but the advertising value is spread out over many matches throughout the season.

- Continuous Engagement: The Premier League maintains a consistent level of engagement throughout its season, with cumulative viewership far exceeding that of the NFL. However, the advertising value is diluted across multiple games, reducing the impact of any single match.

- Regional Variability: The Premier League’s global audience means varying advertising values depending on the region. Markets with lower economic conditions may not contribute as significantly to overall revenue compared to the high-value U.S. market for NFL games.

The higher brand valuation of NFL teams compared to Premier League clubs, despite the Premier League’s larger global audience, can be attributed to a collective of factors featured in this article.

The NFL’s lucrative broadcasting deals, frequent commercial opportunities, centralized revenue-sharing model, and the high economic value of the U.S. market create a financially robust environment that supports high franchise valuations.

In contrast, the Premier League’s fragmented revenue model, fewer advertising opportunities due to continuous play, and variable market dynamics contribute to lower overall revenue and ultimately club valuations. These structural and economic differences explain why NFL franchises often achieve higher valuations, highlighting the complex interplay between market dynamics, revenue models, and cultural significance in the world of sports.

Thanks for reading, David Skilling

wfxx69

oo6sx0